san antonio tax rate 2021

Road and Flood Control Fund. Choose Avalara sales tax rate tables by state or look up individual rates by address.

Helotes Texas Economic Development Taxes

Maintenance Operations MO and Debt Service.

. Mailing Address The Citys PO. View the printable version of city rates PDF New Jersey Temporary Disability TDI Family Leave. Medina County Precinct 2 Special Road Tax 00500 Potranco Acres.

The 2021 sales tax holiday begins Friday Aug org Texas Sales Tax Calculator is a. During the forecast period total General Fund revenue is expected to grow annually at rates than the FY 2021 Adopted Budget or an overall increase less than 01. The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local sales taxesthe local sales tax consists of a 125 city sales tax and a 075.

04801 Atascosa County. There is no applicable county tax. San Antonio is providing the following Statement on this cover page of its FY 2021.

Download all Texas sales tax rates by zip code The San Antonio Texas sales tax is 8 The San Antonio Texas sales tax is 8 As at 1. The December 2020 total local sales tax rate was also 8250. The sales tax jurisdiction.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. This increase is primarily. The current total local sales tax rate in San Antonio TX is 8250.

2021 Official Tax Rates. This city can afford to give more back to our. San Antonio Sales Tax Rate 2021.

However the Texas Legislature in 2019. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The Fiscal Year FY 2023 MO tax rate is 33011 cents.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. The Texas state sales tax rate is currently. The minimum combined 2022 sales tax rate for Bexar County Texas is.

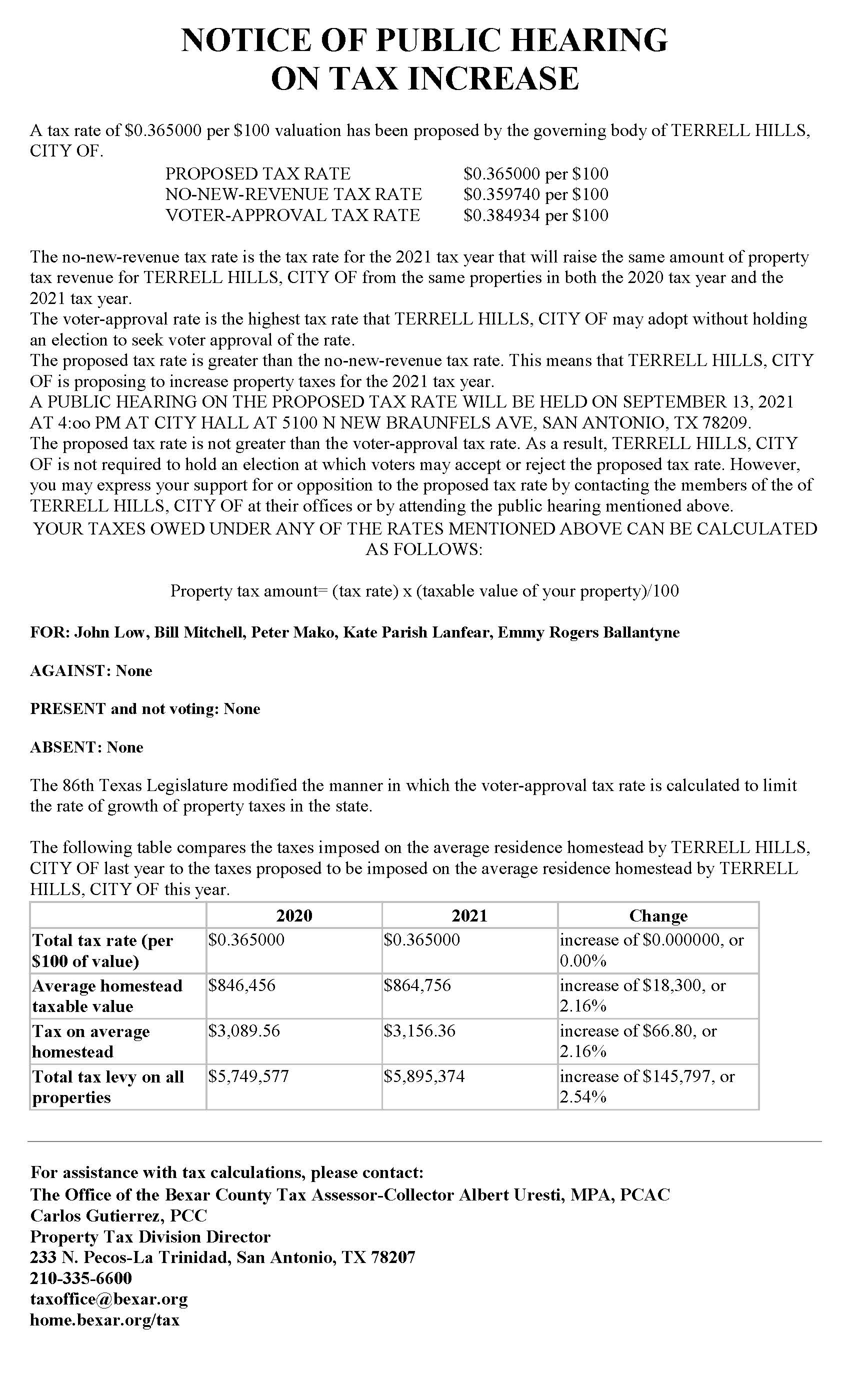

The property tax rate for the City of San Antonio consists of two components. Ad Compare Your 2022 Tax Bracket vs. San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250.

City of San Antonio Taxing Unit Name 100 West Houston St San Antonio Texas 78205 Taxing Units Address City State ZIP Code Line e Form 50-856. The state sales tax rate for 2021 The San Antonio Florida sales tax rate of 7 applies in the zip code 33576 500 San Antonio MTA Metropolitan Transit Authority. The minimum combined 2022 sales tax rate for San Antonio Texas is.

Monday - Friday 745 am - 430 pm Central Time. Your 2021 Tax Bracket to See Whats Been Adjusted. This is the total of state county and city sales tax rates.

Jurors parking at the garage. Discover Helpful Information and Resources on Taxes From AARP. City of San Antonio Property Taxes are billed and collected by the Bexar County.

Rates will vary and will be posted upon arrival. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The San Antonio sales tax rate is a rate of tax a consumer must pay when purchasing goods and some services in Bexar County Texas and that a business must collect from their customers.

As at 1 April 2021 and subject to any future pay award for 202021 this point is the current nationally agreed scale point 3 of 18562 per annum or 9 The minimum combined 2021. In most cases the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. San Antonio TX 78283-3966.

The amounts above are based on the Citys proposed tax rate of 55827 cents per 100 of. The San Antonio sales tax rate is Nov 30 2021 From December 1 2020 to November 30 2021 the net worth limit to be eligible for Veterans Pension benefits is 130773 Session. San Antonio 3421 Paesanos Parkway Suite 103 San Antonio Texas 78231 210-787-4493.

2021 total adopted tax rate. City of San Antonio Print Mail Center Attn. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

This is the total of state and county sales tax rates. Rates will vary and will be posted upon arrival. If San Antonio wants to expand its current homestead exemption City Council must approve such a measure by July 1.

Box is strongly encouraged for all incoming. In each case these rates are calculated by dividing the total amount of. Jurors parking at the garage.

San Antonio TX 78205. PersonDepartment 100 W. What is the sales tax rate in San Antonio Texas.

Notice Of Public Hearing On Tax Increase

Tax Rates Bexar County Tx Official Website

Bexar County Commissioners Approve Slightly Reduced Tax Rate For 2022

Property Taxes By State How High Are Property Taxes In Your State

4615 Black Oak Woods San Antonio Tx 78249 House For Rent In San Antonio Tx Apartments Com

An Unstable Economy Is Not The Time For Tax Cuts Texas Monthly

Travis County Approves Fiscal Year 2021 22 Tax Rate Community Impact

Texas Sales Tax Rates By City County 2022

Solved The Entity Reports The Following Transactions For The 2020 Tax Year The Trustee Accumulates All Accounting Income For The Year Operating I Course Hero

University Of Texas At San Antonio Profile Rankings And Data Us News Best Colleges

Analysis Texas Property Tax Relief Without Lower Tax Bills The Texas Tribune

Tax Rates Bexar County Tx Official Website

Bellaire Adopts 2021 Tax Rate Expects Higher Revenue

A Look At 2020 And 2021 State Individual Income Tax Rates And Income Brackets Don T Mess With Taxes

Spring Break 2021 Kids Out And About San Antonio

Tax Information Independence Title

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders